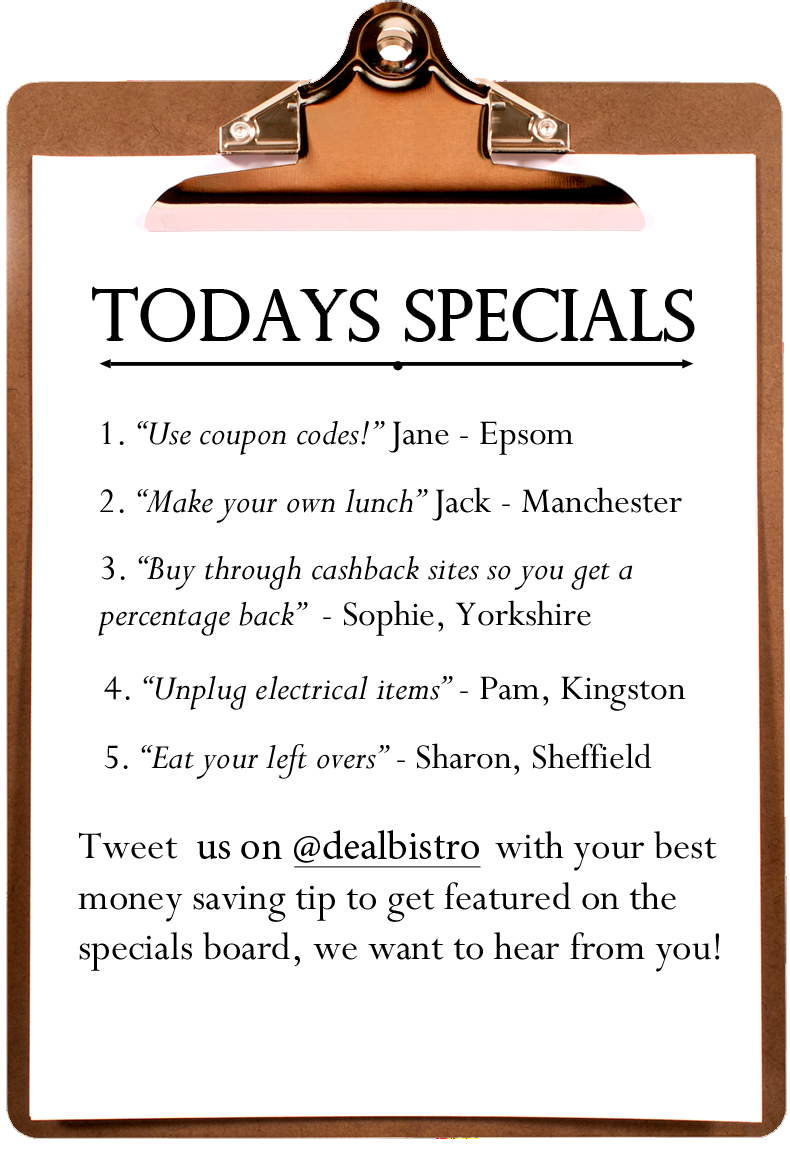

OUR MOST POPULAR READ:

Click through to see what The Chef's Top Ten Money Saving Tips are for 2018. We’ve started at the basics. Cutting your food bills down, turning off electricity when its not being used and taking advantage of the very free things that life has to offer!

The chef has selected these money saving tips based on what he was asked most last year. If taken seriously, these money saving tips could save you and your family a small fortune throughout the year!

After reading this article please get in touch to let us know which tip helped you out most! Tweet @dealbistro

1. Start online shopping

Making a trip to the Supermarket can not only be a struggle to get to, but also an expensive trip. Unless you’ve made a shopping list and follow it religiously, it’s easy to be distracted by the tricks that make you fill your trolley.

By online shopping you’re more likely to order what you actually need as opposed to getting caught out by those eye catching deals. Most online shopping websites allow you to save your weekly shop instead of you having to add it all again the following week.

2. Clear your credit card debt

Credit card debts can be very daunting. They are convenient when you need to pay for goods and services throughout the month, however the APR percentage can make it extremely difficult to pay back. A way to clear the balance could be to get a low cost loan. A low cost loan could have half the APR percentage, so overall you have less to pay back.

3. Take a trip to the market

Eat healthily for less by using your local market stalls. When it comes to fruit and veg in particular, market prices are normally a quarter of Supermarket prices. Whether you’re doing an online shop or making a weekly trip to the supermarket, you can save yourself money by getting fresh products and helping out local businesses – what could be better?

4. Don’t automatically renew insurances

Whether it’s home insurance, travel insurance or car insurance, you should never automatically renew them with the same company. Whether or not you are happy with the service they are providing, it is always worth looking up other providers and getting free quotes. Most of the time, quotes from other providers are cheaper. If this is the case but you don’t actually want to leave your current provider, question whether or not they can price match that particular quote.

5. Book trips early

Low cost airlines seem to be bigger and better than ever! Flights starting from just £27, you can’t go wrong! Peak seasons however, the same tickets could be sold for up to four times the amount! Like anything, when there is a lot of demand, companies increase prices as they know that a lot of people will happily pay for them. Booking your trips in advance can save you and your family a lot of money.

6. Sell unwanted items

How many clothing items do you have in your wardrobe that you haven’t worn in over a year? Some of us can genuinely say none, as they’re already somebody who recycles their clothes, however most of us have a lot of unwanted clothes. Why not sell them to someone who will wear them? There are many online sites where you can sell second hand clothes.

7. Avoid expensive days/nights out

Theme parks, restaurants and theatres are just a few examples of popular activities that you attend with friends and family. Even though they are all great fun, they can all be quite costly. There are many museums that are free to attend, along with castles, galleries, historic houses etc. If you’re a TV fanatic, there are websites you can sign up to that will send free audience tickets for a number of programmes that are showed on major channels.

8. Walk more

Although it sounds obvious, not only will walking to your destination improve your health but it can also save you a lot of money. We have become so familiar with just jumping in the car to make a short journey down the road. Although it is only a short journey, short journeys end up costing more than what a longer journey would.

Also, if you get on the train/tube to work, why not jump off the station before. Yes, it may take more time than usual but eventually you will start to notice the saving that you are making from missing that one stop.

9. Cancel your gym membership

Joining a pay-as-you-go gym can save you a fortune. A monthly subscription on average costs around £40 a month. To make this worthwhile you should probably be going to the gym around 3 times a week. If you are not doing that then it will work out cheaper to pay on the day at a pay-as-you-go gym. It’s bad enough knowing that you’re not as committed as when you initially joined up, but it is also an added expense. There is no pressure to go to a pay-as-you-go gym and whilst your not wasting £40 a month, you could be saving up for your own home gym equipment!

10. Cut down drinking and/or smoking

Whether you’re having a couple of beers/wines after work or you are someone who enjoys going partying at the weekend, drinking can be really expensive. You could potentially save thousands of pounds every year. If you’re an every day smoker, this can cost you between £1,000 and £4,000 a year depending on how many you smoke each day. Quitting smoking will not only see improvements on your health but also your finances!

ASK THE CHEF